House Insurance Flood Zone 3

1222020 Its not unusual for the property to be in a couple different flood zones because of the way FEMA does their flood maps. If your home floods well deal with your claim as normal.

When Why And How To Purchase Flood Insurance In New York City Cityrealty

When Why And How To Purchase Flood Insurance In New York City Cityrealty

12142013 Meanwhile those living in flood-prone properties will see their insurance bills capped.

House insurance flood zone 3. Be prepared to pay more. The type of flood zone you live in has a huge effect on the price of your flood insurance. FEMAs low and moderate risk flood zones those outside the SFHA are those that begin with the letters X B or C Flood insurance is not required within these zones.

5182014 Phoned EA who say that the reason we are zone 3 is because of the brook 150m not the one in the back yard. 8112020 Homeowners with a Fannie Mae Freddie Mac FHA USDA or VA loan are all required to have flood insurance coverage if their property is in an A- or V-designated flood zone. On further research it appears that flood defences are in place and the report does say that there is no record of any flooding to the property or adjoining property and no record of previous insurance claims due to flooding.

It usually covers flooding thats caused by nature such as rain or overflowing rivers or canals. The zones only refer to areas at risk of flooding from rivers or the sea although not all rivers have been included in calculating the zones. In the most extreme cases a home in a V zone can cost 100 or even 200 what it costs to insure a home in a B C or X zone.

Areas in flood zone 1 are least likely to experience flooding during the year whereas those in flood zone 3 are most likely to experience flooding during the year. All banks and lenders require federal flood insurance if the property theyre lending to is in a special hazard flood area. Homes in Council Tax bands A and B will pay no more than 210 a.

There are three different flood zones. If a property covers two or more flood zones the insurer will rate the premiums based on the most hazardous zone. While flood insurance is not federally required for any homeowner or business owner mortgage lenders require you to purchase adequate flood insurance if you reside or maintain your business in one of FEMAs high-risk flood zones.

If your house is in a flood zone. If you are worried about the flood information about the history of floods in your area and the damage caused by previous floods should give you an idea. If youre considering buying or building in a special hazard flood area then this should be on your list of things to purchase.

1312021 Whilst you can buy a house in a flood 2 zone you should be aware that the mapping system for floods in the UK is not completely accurate. Then enter your address and add the flood zone layers and you will be able to see how and if your property lies over a flood zone. Homes built more than 400m from a source of running water pay an average of 95 for their home insurance every year compared with an average of 125 for those less than 400m away.

322020 Home-owners who have been the victims of flooding before can expect to pay more than double at an average of 199. 11172016 There are 3 flood zones as defined by the EA. We are going to look at 3 types of flood zones and what they mean for your lake property.

Homeowners and business owners in flood zone D may still purchase flood insurance and are strongly encouraged to do so. There should also be information available about the extent of the flood risk. Flood zone X is the best case scenario for your Lake Oconee property.

Definitions for all FEMA flood zones are provided in the table below. 2132021 When building in a flood zone you must consider insurance. It doesnt tend to cover escape of water flooding caused by burst pipes or a problem with the water main.

What Flood Zones Require Flood Insurance. Each insurer has a different view of flood risk and this will be reflected in their decision to offer cover and what price to charge. These areas have been defined following a national scale modelling project for the EA and are regularly updated using recorded flood extents and local detailed modelling.

The average flood insurance policy costs around 700 per year. That depends whether you are worried about the possibility of a flood destroying your property or about the effect your flood zone has on your home valuation and your overall insurance expense. 1 in 30 chance of flooding Aeschylus 34.

A flood zone 2 sits in-between flood zone 3 which is a very high risk of flood and flood zone 1 which is the lowest risk of flood. These zones could still have flood risk as historically more than 20 of NFIP claims are made by policyholders in a X B or C zone. They said their house insurance was no higher and the wife thinks it is safe to offer but I am nervous 1 in 30 sounds like low odds to me 339 chance according to the flood website.

Flood Zone 1 2 and 3. 10182017 How flood zones affect home insurance costs. A Areas subject to inundation by the 1-percent-annual-chance flood.

Flood insurance can cover you for repairs replacements or even a rebuild depending on the extent of the damage. 232017 Would you buy a house in flood zone 3. If we feel we cant offer you a competitive quote well transfer the flood element of your cover into the Flood Re scheme.

The Low Down On Flood Zone Designations For Charleston Myrtle Beach Real Estate Premier One

Solved Can You Please Answer For Me These Objectives Flo Chegg Com

Solved Can You Please Answer For Me These Objectives Flo Chegg Com

How To Save Money On Flood Insurance Michigan

How To Save Money On Flood Insurance Michigan

Flood Zones Insurance Ri Shoreline Change Special Area Management Plan

Elevation Certificates Vbgov Com City Of Virginia Beach

Elevation Certificates Vbgov Com City Of Virginia Beach

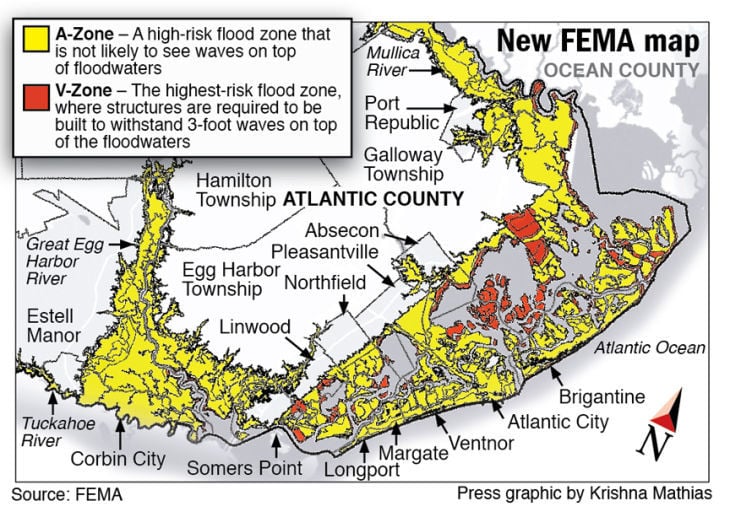

Fema Shrinks Flood Zones On New Maps A Relief To Homeowners Local News Pressofatlanticcity Com

Fema Shrinks Flood Zones On New Maps A Relief To Homeowners Local News Pressofatlanticcity Com

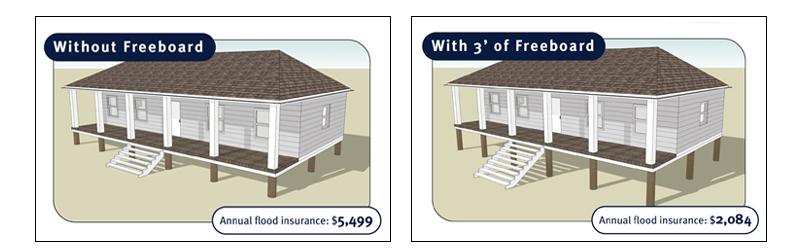

Using Freeboard To Elevate Structures Above Predicted Floodwaters Mass Gov

Using Freeboard To Elevate Structures Above Predicted Floodwaters Mass Gov

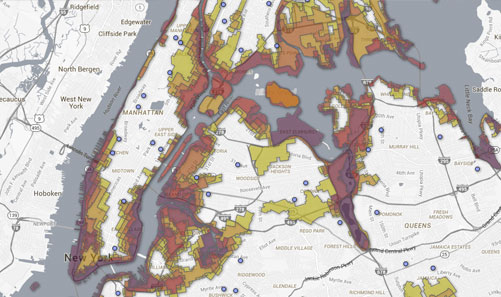

A Guide To Understanding Nyc Flood Zones Cityrealty

A Guide To Understanding Nyc Flood Zones Cityrealty

Climate Resiliency Frequently Asked Questions

Climate Resiliency Frequently Asked Questions

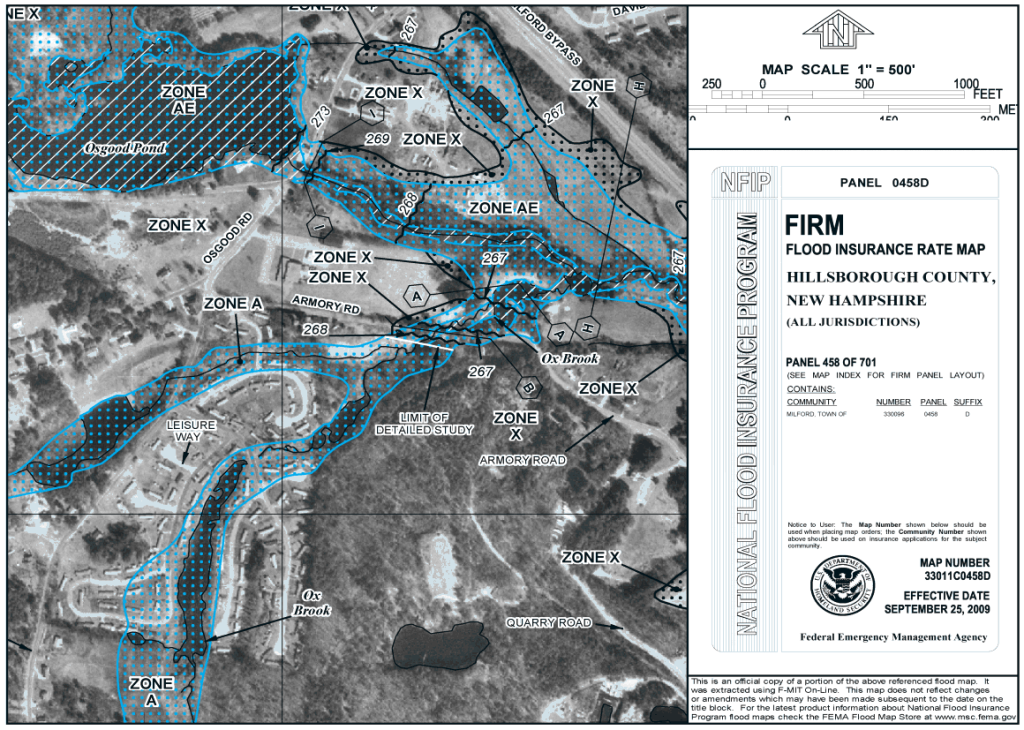

Fema S Flood Zone Maps Planning And Building

Fema S Flood Zone Maps Planning And Building

Department Of Engineering Flood Zones Flood Zone Definitions

Forbes Guide To Flood Insurance Forbes Advisor

Forbes Guide To Flood Insurance Forbes Advisor

3 Flood Risk Management And A Precedent For A Community Based Flood Insurance Option A Community Based Flood Insurance Option The National Academies Press

Solved Can You Please Answer For Me These Objectives Flo Chegg Com

Solved Can You Please Answer For Me These Objectives Flo Chegg Com

Https Ec Europa Eu Environment Water Flood Risk Flood Atlas Pdf Flood Maps Ch6 Pdf

Homeowners Insurance Vs Hurricane Insurance Vs Flood Insurance What S The Difference Moving To Kona

Homeowners Insurance Vs Hurricane Insurance Vs Flood Insurance What S The Difference Moving To Kona

Post a Comment for "House Insurance Flood Zone 3"