Insurance Accounting Ifrs 4

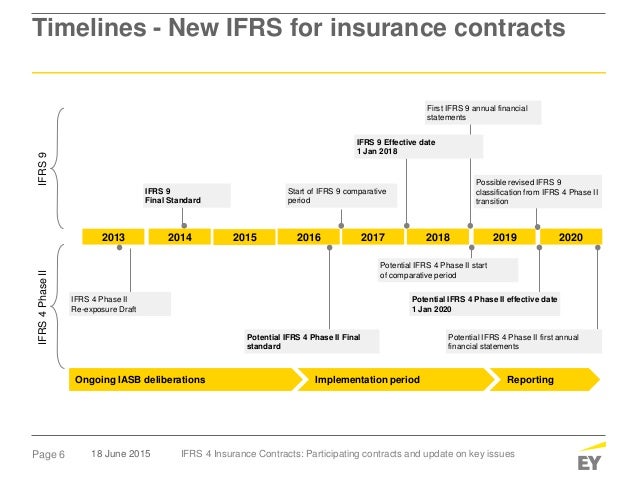

5312016 IASB completes redeliberations on amendments to IFRS 4 Insurance Contracts regarding the application of IFRS 9 Financial Instruments Insurance Accounting Alert - IASB meeting IFRS 4 IFRS 9 May 2016 EY China. Phase 1 of the insurance accounting project set out in IFRS 4 will aid in the analysis of insurers and is a useful stepping stone to the more valuable phase 2.

Volume C - UK Reporting - International Financial Reporting Standards Volume D - UK Reporting - IFRS 9 and related Standards Volume E - UK Reporting.

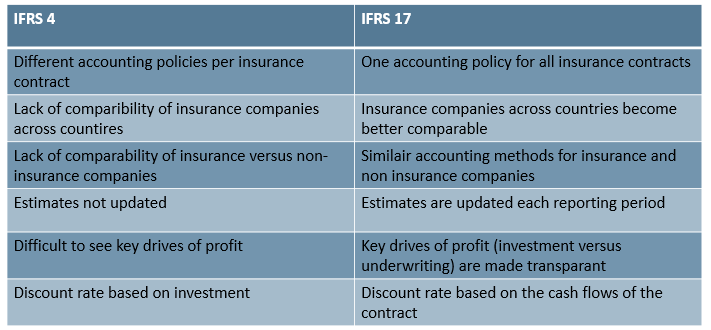

Insurance accounting ifrs 4. Insurance contracts that an entity issues and reinsurance. An interim solution IFRS 4 consists of general principles There is some freedom to define the concrete accounting policy according to IFRS 4 One fundamental principle of IFRS 4 allows the insurer to change its accounting policy if and only if the new valuation method is moving in the direction of market. It is highly recommended that insurers gain a full understanding of IFRS 4 as requirements and disclosures are onerous.

2152011 The objective of this IFRS is to deal with the financial reporting for insurance contracts by an entity that issues insurance contracts. OBJECTIVE The objective of IFRS 4 is to specify the financial reporting for insurance contracts by any entity that issues such contracts described in IFRS 4 as an insurer. Since IFRS 4 is only.

Practical Considerations Pricing Optimisation IFRS - Acronyms IFRS - International Financial Reporting Standards IASB - International Accounting Standards Board. Measuring insurance liability on undiscounted basis Measuring contractual rights to future investment management fees at an amount that exceeds its fair value using non uniform accounting policies for the insurance liabilities of subsidiaries. Measurement Model Building Block Approach Onerous Contracts Test 3.

Do not unbundle if investment. SCOPE IFRS 4 applies to. The standard was published in March 2004 and is effective from 1 January 2005.

IFRS 4 Insurance Contracts provides guidance on the accounting treatment of all insurance contracts except for specific contracts covered by other standards. Unbundling is only allowed if it is required. Deloitte Accounting Research Tool.

The introduction of new accounting rules in different areas in the next years will pose a significant challenge for insurers. 4302016 During the April 2016 meeting the International Accounting Standards Board continued its redeliberations on proposed amendments to IFRS 4 Insurance Contracts to allow entities issuing contracts within the scope of IFRS 4 to mitigate certain effects of applying IFRS 9 Financial Instruments together with IFRS 4 before the new insurance contracts standard IFRS 4. Introduction to IFRS 4 Phase II Four key concepts for Non-Life Insurers 2.

IFRS 4 Phase II unbundling prohibited if not required Step 1. The agency notes that there is still much to do in defining the accounting for phase 2 and finding a balance between sophistication consistency and practicality will be highly. Accounting policy IFRS 4 Phase I IFRS 4 permits to continue with current accounting policies except.

It does not apply to other assets and liabilities of an insurer such as financial assets and financial liabilities within the scope of IFRS 9. Its accounting policies for insurance contracts and related assets liabilities income and expense Recognised assets liabilities. IFRS 4 applies to all insurance contracts including reinsurance contracts that an entity issues and to reinsurance contracts that it holds except for specified contracts covered by other Standards.

More restrictive in comparison to current IFRS 4 Phase I An insurance contract may contain one or more components that would be within the scope of another standard if they were separate contracts. IFRS 4 is applicable for annual reporting periods commencing on or after 1 January 2005. DISCLOSURE An insurer is required to disclose information that identifies and explains the amounts arising from insurance contracts.

IFRS 4 International Financial Reporting Standard 4 Insurance Contracts Objective 1 The objective of this IFRS is to specify the financial reporting for insurance contracts by any entity that issues such contracts described in this IFRS as an insurer until the Board completes the second phase of its project on insurance contracts. IFRS 4 Insurance Contracts. The new accounting framework introduced by IFRS 17 and IFRS 9 for financial instruments is considered the most significant accounting change since the publication of IFRS 4.

Ifrs 4 Insurance Contract Ias 24 Related Party Disclosure

Ifrs 4 Insurance Contract Ias 24 Related Party Disclosure

Ifrs 4 Insurance Contracts Participating Contracts And Update On Key

Ifrs 4 Insurance Contracts Participating Contracts And Update On Key

Ifrs 4 Insurance Contract Ias 24 Related Party Disclosure

Ifrs 4 Insurance Contract Ias 24 Related Party Disclosure

An Introduction To Ifrs 9 And Ifrs 17 Ifrs 17

An Introduction To Ifrs 9 And Ifrs 17 Ifrs 17

Ifrs 4 Insurance Contracts Theactuary Net Actuarial Knowledge

Ifrs 4 Insurance Contracts Participating Contracts And Update On Key

Ifrs 4 Insurance Contracts Participating Contracts And Update On Key

Update Ifrs 4 Insurance Contacts Summary Note Chartered Education

Update Ifrs 4 Insurance Contacts Summary Note Chartered Education

The Financial Insurance Investment Blog Framework Ifrs 17 Insurance Contracts Part 1 Summary And Features

The Financial Insurance Investment Blog Framework Ifrs 17 Insurance Contracts Part 1 Summary And Features

Post a Comment for "Insurance Accounting Ifrs 4"