Insurance Broker Profit Split

4272020 The insurance sectors net profit margin NPM for 2019 was roughly 63. 182018 As compared to the full-service agents split which is 694 percent or 69400 the full-service agent nets 7088 more than his or her 95-5 percent counterpart.

Insurance For Small Business Price

Insurance For Small Business Price

7102020 The most straightforward method is a simple fee arrangement between broker and client.

Insurance broker profit split. Typically an insurance agent is paid a commission or percentage of the total insurance premium the insurer charges for a given policy. The key profit indicatorlife return on equity RoErose from 11 percent in 2014 to 118 percent in 2015 but is expected to stabilize at the lower level of 10 percent going forward. Dollars in 2019 Marsh.

Insurance company pays agencybrokerage firm 10 or 10K commission. Agencybroker pays their producer 4K for a. A not-for-profit entity that has issuedor is a conduit bond obligor forsecurities traded listed or quoted on an.

States and Western Europe. The business stated that UK brokers had seen average profit margins increase consistently over the past year with the exception of companies with sales between 3m and 5m which saw average profit margins drop from 106 to 76. As of 2019 the largest insurance brokers in the.

The filing detailed that 674m of turnover was contributed from its broking operations while 19m came from its claims handling business. There is a very wide difference in the take-home pay of experienced insurance agents and brokers and new ones because experienced ones tend to sell more policies and earn more commissions. Most commissions are between 2 and 8 of premiums depending on state regulations.

The contingent is usually paid once a year. 1242021 How Property and Casualty Insurance Agents Are Paid. Property and casualty insurance.

Insurance brokers play a significant role in helping companies and individuals procure property and casualty liability insurance life insurance and annuities and accident and health insurance. An insurance broker is distinct from an insurance agent in that a broker typically acts on behalf of a client by negotiating with multiple insurers while an agent represents one or more specific insurers under a contract. This also helps ensure that no individual clients loss can have a major effect on the brokers result.

Client pays 100K premium. With property-casualty carriers homeowners auto business insurance etc the profit is split based on a contingent. 5152013 If the split was higher on the book you purchased then you probably have an argument for an increased share with the agency principals.

Revenue Changes for Insurance Brokers Insurance brokers will see a change in revenue recognition after adopting Accounting Standards Update ASU. Brokers must meet a minimum amount of profitability to qualify for this type of profit sharing. 2132017 Similarly most states also limit the payment of insurance commissions to either individuals licensed as an insurance agent or entities that are properly registered as an insurance agency or insurance brokerage firm.

The greater the amount of business a broker offers us the greater amount of profit share they earn. Turnover went down to 865m from 879 in 2019 and profit before tax dropped to 50m 2018. More commonly the broker earns a commission which is agreed with the insurer but taken out of the premium paid by the insured.

6242019 The figures showed that average profit margins are 57 for the current year which is up from 54 for last year. Life insurance companies had an average NPM of 96. With revenue amounting to over 16 billion US.

9192019 Commission Split. Property and Casualty auto home and business insurance agents typically earn anywhere between 7 and 20 commission on each policy sold. Few of them tend to earn more than 100000 a year.

Splitting insurance commissions towith non-licensed entities is generally forbidden as well. This commission split is in line with commission splits offered by competitor brokerage firms such as Keller Williams. 1022020 The statistic presents the leading insurance brokers worldwide in 2019 by revenue.

Some insurers try to encourage agents and brokers to write new policies by paying a higher base commission for new policies than for renewals. Which is a form of profit sharing based on loss experience. The average annual salary and wages of an insurance agent or broker is around 50000.

Having said that in my experience commission splits range from 9010 all the way to 3070 with 70 pct going to the producer. 1152021 An insurance broker makes money off commissions from selling insurance to individuals or businesses. 2132021 If you purchase a liability policy for a 2000 premium your agent will collect 2000 from you retain 300 in commission and send the remaining 1700 to your insurer.

These figures were broadly in line with what it reported in 2018. Exit Realty has a 70-30 commission split with 70 going to the agent and 30 going to the broker. The global PC insurance industry has remained stable over the past five years growing at a steady 4 to 5 percent.

They make money off commissions from selling insurance to individuals or businesses. An insurance broker is an intermediary who sells solicits or negotiates insurance on behalf of a client for compensation. An insurance broker sells solicits or negotiates insurance for compensation.

The insurance company looks at claims paid and determines what portion to share with the broker.

Real Estate Referrals Infographic Househunt Network Real Estate Infographic Real Estate Marketing Real Estate Trends

Real Estate Referrals Infographic Househunt Network Real Estate Infographic Real Estate Marketing Real Estate Trends

Medicare Broker Medicare Insurance Broker For Baby Boomers

Medicare Broker Medicare Insurance Broker For Baby Boomers

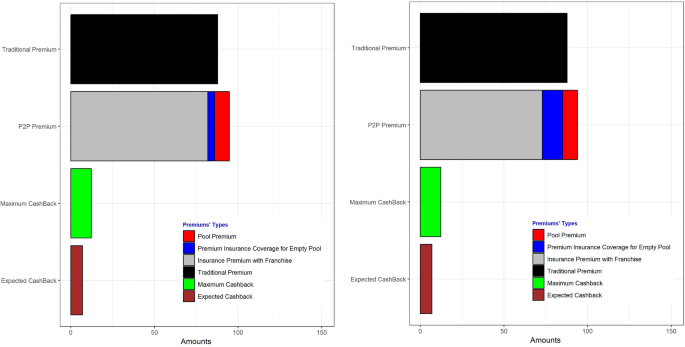

The Broker Model For Peer To Peer Insurance An Analysis Of Its Value Springerlink

The Broker Model For Peer To Peer Insurance An Analysis Of Its Value Springerlink

Pin By Elizabeth Ochoa On 1 Health Insurance Humor Best Health Insurance Supplemental Health Insurance

Pin By Elizabeth Ochoa On 1 Health Insurance Humor Best Health Insurance Supplemental Health Insurance

Cv Examples For Retail Jobs Uk Unique Collection Supervisor Resume Template Top 8 Accounting Supervisor Resume Job Resume Job Resume Template Resume Examples

Cv Examples For Retail Jobs Uk Unique Collection Supervisor Resume Template Top 8 Accounting Supervisor Resume Job Resume Job Resume Template Resume Examples

Check Out This Amazing Template To Make Your Presentations Look Awesome At Sales Funnel Template Sales Funnels Funnel

Check Out This Amazing Template To Make Your Presentations Look Awesome At Sales Funnel Template Sales Funnels Funnel

Crypto Facilities Vs Questrade Fx Forex Broker Comparison Forex Brokers Brokers Forex

Crypto Facilities Vs Questrade Fx Forex Broker Comparison Forex Brokers Brokers Forex

How Are Health Insurance Brokers Paid Simplyinsured Blog

How Are Health Insurance Brokers Paid Simplyinsured Blog

Home Real Estate Careers At Keller Williams Realty Real Estate Career Keller Williams Realty Real Estate Information

Home Real Estate Careers At Keller Williams Realty Real Estate Career Keller Williams Realty Real Estate Information

General Insurance Purchase Distribution Channels 2019 Statista

General Insurance Purchase Distribution Channels 2019 Statista

Difference Between Journal Article And Research Paper With Table Research Paper School Journals What Is Research

Difference Between Journal Article And Research Paper With Table Research Paper School Journals What Is Research

Pin By Lola Ann Hoffman On Resumes Cover Letters Resume Objective Sample Sample Resume Professional Resume Samples

Pin By Lola Ann Hoffman On Resumes Cover Letters Resume Objective Sample Sample Resume Professional Resume Samples

How To Ensure The Optimal Water Quality For Your Home Solar Hot Water Solar Panels For Home Solar Panels

How To Ensure The Optimal Water Quality For Your Home Solar Hot Water Solar Panels For Home Solar Panels

Heffernan Insurance Brokers And Brokertech Ventures Participate In Trustlayer 6 6 Million Seed Financing

Heffernan Insurance Brokers And Brokertech Ventures Participate In Trustlayer 6 6 Million Seed Financing

Insurance Broker Software Helps Reduce Workload And Increase Profit Brokerage Firms Brokers Insurance Broker Brokerage Firm

Insurance Broker Software Helps Reduce Workload And Increase Profit Brokerage Firms Brokers Insurance Broker Brokerage Firm

For Life Insurers Making Money Is A Numbers Game Life Insurance Companies Work On Actuaries To Life Insurance Premium Number Games Life Insurance Companies

For Life Insurers Making Money Is A Numbers Game Life Insurance Companies Work On Actuaries To Life Insurance Premium Number Games Life Insurance Companies

Post a Comment for "Insurance Broker Profit Split"