Insurance Claim Reimbursement Gst

There are also special rules on cash payments and input tax claims. What is reimbursement of Expenses.

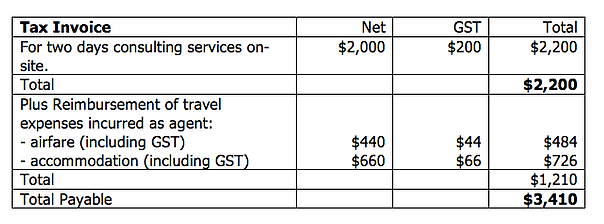

Gst And Reimbursement Of Expenses Webb Martin Consulting

Gst And Reimbursement Of Expenses Webb Martin Consulting

GST charged to you under the Australian tax jurisdiction.

Insurance claim reimbursement gst. If my company gives a 300 gift voucher to our employee do we need to account for any output tax. You can only claim a GST credit for the part of the insurance relating to your business. 10102014 Therefore the Insurance Company will only reimburse you for your net cost.

On the other hand the recovery of a payment made on behalf of another party by you as an agent is termed as a disbursement. You can claim the amount of GST shown on the invoice provided with the goods and services you bought for use in a taxable activity. Doctor visit hospital bills.

You do not have to pay GST on an insurance settlement provided you tell the insurer before making the claim what proportion of the premium you can claim GST credits for. A reimbursement may be subject to GST if it is consideration for a supply of goods or services. You can only claim GST incurred on that part of the premiums not relating to the coverage of medical costs.

GSTVAT incurred for purchases made overseas. You can claim GST credits on the part of the premium that relates to business purposes. In this article we are discussing whether such reimbursement will attract GST or not.

8302020 GST is chargeable on supply of goods and services. Our employees private medical insurance does not payreimburse GST for medical claims eg. In auditadvisory services reimbursement of expenses arises when a supplier incurs any expenses to undertake a transaction on behalf of the recipient who is supposed to incur such expenses on his own account.

352020 Or is GST not claimable by Council on the reimbursement on the basis that the repairer is acting as agent for the insurer and therefore GST is not applicable as indicated by the following comments from the ATO website. For example if you had an insurance claim on a 100 business asset worth 11000 incl 1000 of GST when you purchase a replacement asset you will be able to claim all the GST on the purchase back in your next BAS. There are some paymentsreceipts which are reimbursement of expenses in relation to supply of the main servicegoods.

If youre eligible for a GST credit on an insurance policy you can claim it through your activity statement. Tax invoices for GST. You cant claim GST credits on.

Generally GST is charged on insurance policies other than. A disbursement does not constitute a supply and hence is not subject to GST. The complexities of the insurance business have led to the development of special GST rules for the insurance sector such as for premiums recovery of insurance excess and third party claims.

Treatment of reimbursement expense under GST. For the insured person to be entitled to claim an ITC in respect of the GSTHST paid or payable on the acquisition of services or property all requirements for claiming an ITC must be met including the requirements that the insured person be a GSTHST registrant that the property be for consumption use or supply in the course of the insured persons commercial activities and that it is the insured person who is required to pay the GST. Yes the company can claim GST incurred for the portion of the expenses relating to business use if the company records the expense in its accounts and maintains evidence of the reimbursement.

It is necessary to be familiar with the GST. Most of the time claiming GST will be easy. However under the GST Transition Act as a transitional measure no input tax credit can be claimed in respect of compulsory third party motor vehicle insurance policies until 1 July 2003.

For supplies costing more than 50 you must hold a tax invoice when you claim the GST on your return. A GST-registered business can claim an input tax credit for the GST paid on an insurance policy except to the extent that it makes an input taxed supply. Input tax claims are disallowed because the GSTVAT was paid to a party outside of Singapore tax jurisdiction.

Insurance company has to account for GST on all imported services as if it is the supplier except for certain services which are specifically excluded from the scope of reverse charge. Guide on Reimbursement and Disbursement of Expenses 2 If you incur the expenses as a principal If you pay the expenses as an agent The recovery of expenses is a reimbursement a disbursement GST treatment The recovery of the expenses from another party may amount to a supply and may be subject to GST or exempt from. I have spoken with a couple of International Insurance companies in Singapore and have been advised that this is a local Singapore practice.

The person who acts on behalf of someone can be termed as Agent. It will also be entitled to claim the corresponding GST as its input tax subject to.

Https Www Fleetpartners Com Au Sites Default Files Fp Insurance Reimbursement 08 2015 2 Pdf

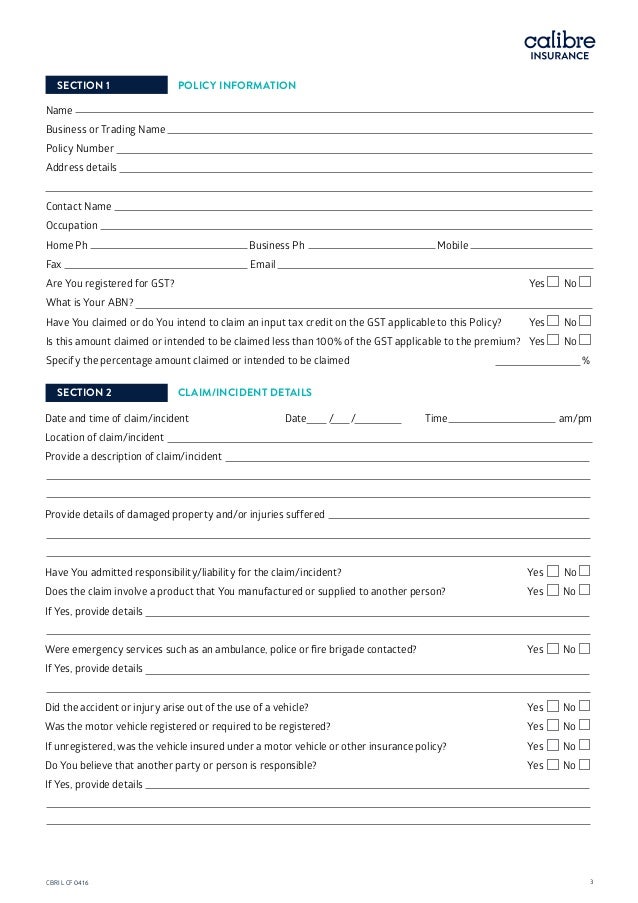

Free 27 Sample Claim Forms In Ms Word

Free 27 Sample Claim Forms In Ms Word

Https Www Grantthornton Sg Globalassets 1 Member Firms Singapore Pdf Articles Back To Basics Gst Pdf

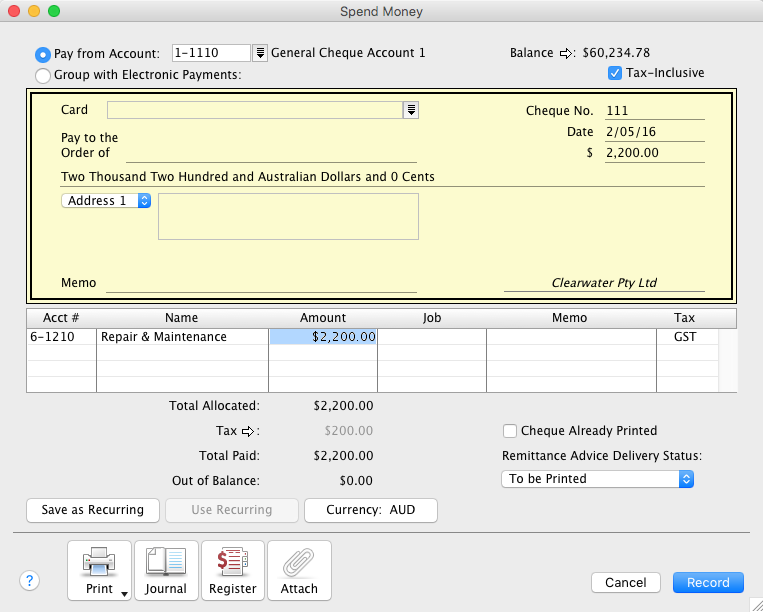

Insurance Settlements Australia Only Support Notes Myob Accountedge Myob Help Centre

Insurance Settlements Australia Only Support Notes Myob Accountedge Myob Help Centre

Iras Conditions For Claiming Input Tax

Iras Conditions For Claiming Input Tax

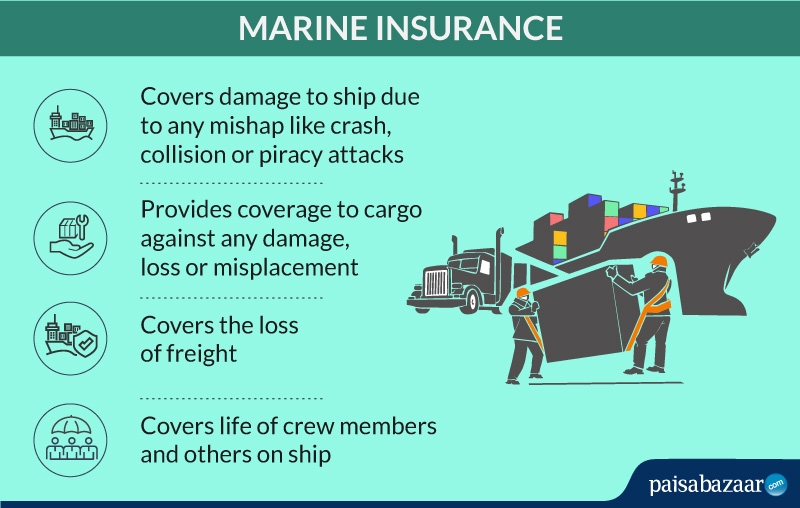

Marine Insurance In India Types Coverage Claim Exclusions

Marine Insurance In India Types Coverage Claim Exclusions

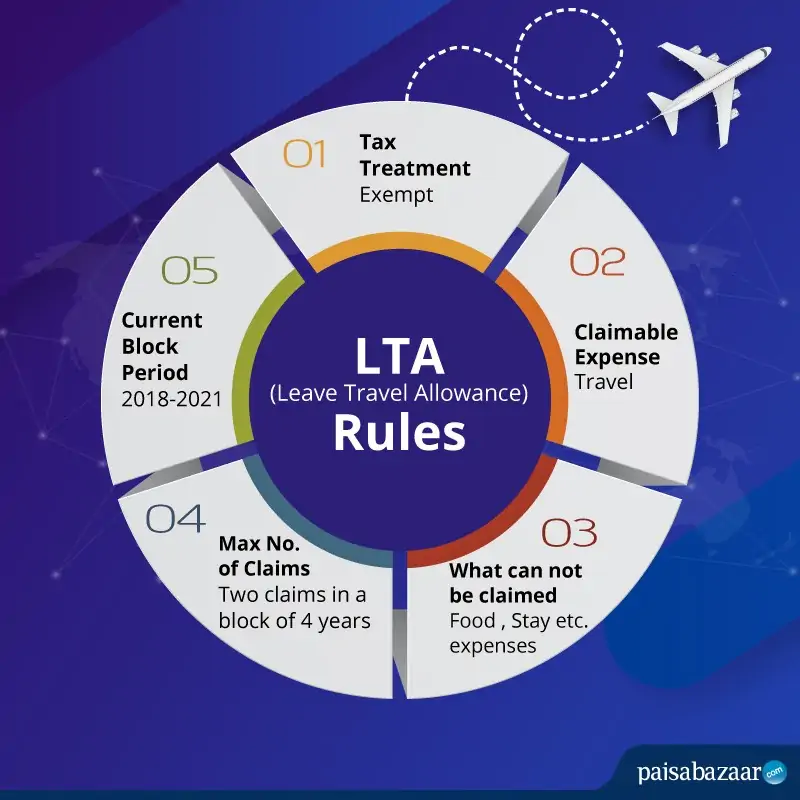

Leave Travel Allowance Lta Claim Rule Eligibility Tax Exemptions

Leave Travel Allowance Lta Claim Rule Eligibility Tax Exemptions

Gst And Settlement Of Insurance Claims

Gst And Settlement Of Insurance Claims

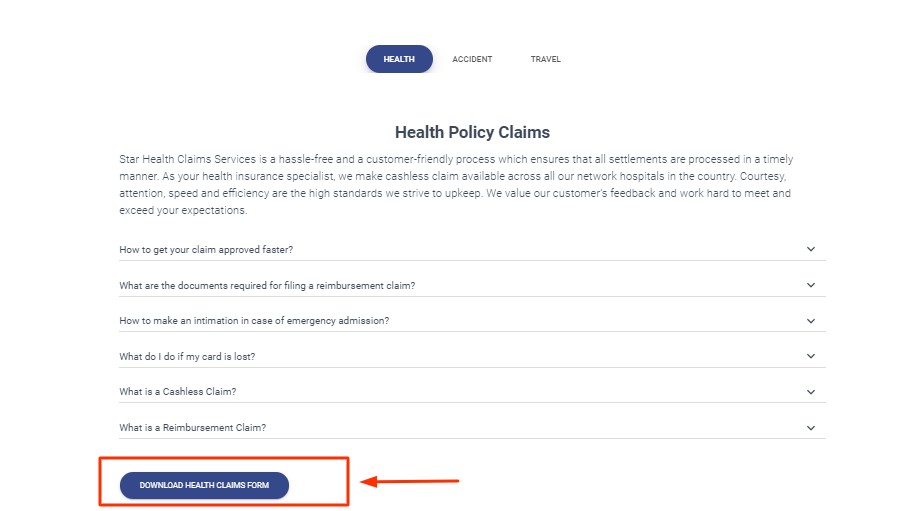

Star Health Insurance Claim Renewal Process

Star Health Insurance Claim Renewal Process

Insurance Claim For Loss Of Stock

Insurance Claim For Loss Of Stock

Here S How You Can Settle Insurance Claims Smoother Faster

Here S How You Can Settle Insurance Claims Smoother Faster

Understanding General Insurance Claims And Gst Mitchell Insurance Management

Understanding General Insurance Claims And Gst Mitchell Insurance Management

Https Www Grantthornton Sg Globalassets 1 Member Firms Singapore Pdf Articles Back To Basics Gst Pdf

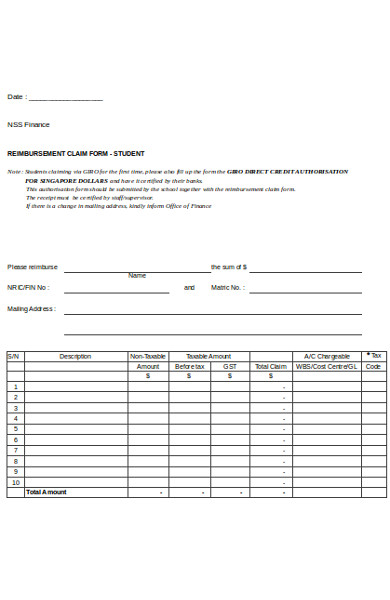

Free 6 Claim Reimbursement Forms In Ms Word Pdf Excel

Free 6 Claim Reimbursement Forms In Ms Word Pdf Excel

Input Tax Credit Guide Under Gst Calculation With Examples

Input Tax Credit Guide Under Gst Calculation With Examples

Bajaj Allianz Health Insurance Check Plans Reviews Online

Bajaj Allianz Health Insurance Check Plans Reviews Online

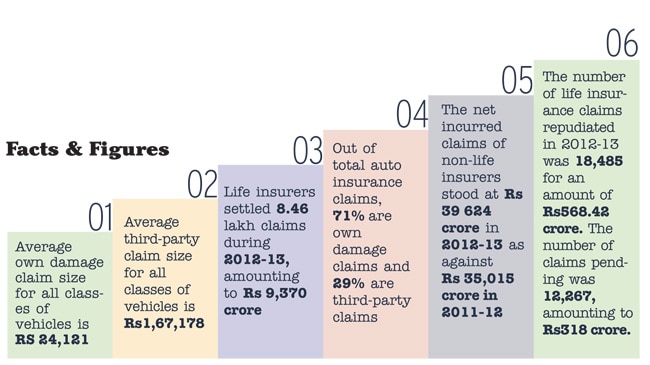

Gst Impact Of Gst On Auto Insurance Auto News Et Auto

Gst Impact Of Gst On Auto Insurance Auto News Et Auto

Insurance Settlements Australia Only Support Notes Myob Accountedge Myob Help Centre

Insurance Settlements Australia Only Support Notes Myob Accountedge Myob Help Centre

Post a Comment for "Insurance Claim Reimbursement Gst"