Insurance Pricing Regulation

New regulations including Solvency II require insurers to maintain higher capital levels without decreasing overall returns and to do that insurers must either reduce costs or increase pricing. A drugs price and reimbursement can differ within jurisdictions of Canada and may change over the life cycle of the drug.

Denmark Denmark Detailed Assessment Of Observance Of The Insurance Core Principles

Denmark Denmark Detailed Assessment Of Observance Of The Insurance Core Principles

9102008 Price regulation and regulation in general increases surveillance costs requiring more regulatory staff and higher budgets but it also requires more expense and time for insurance company compliance with forms and prices.

Insurance pricing regulation. Insurance regulatory focus areas for 2021. Differential markups lead to price variation apart from cost variation. Requirements on firms to report certain data sets to the FCA so that it can check the rules are being followed.

We analyze insurance-pricing regulation under imperfect competition on the Massachusetts health insurance exchange. Changing regulation plus the ongoing pandemic could have an impact on the cost of general insurance causing significant downward pressure on premium rates across both personal and. 9212020 Product governance rules requiring firms to consider how they offer fair value to all insurance customers over the longer term.

Simply put a rate is the price per unit of coverage. Making it simpler to stop automatic renewal across all general insurance products. Operational resilience and workforce transformation.

The Financial Conduct Authority FCA has published the long-awaited final report for its general insurance pricing practices market study which suggests that some consumers are still not getting fair value for their purchases. Digital transformation and data. The pure premium refers to that portion of the rate needed to pay losses and loss adjustment expenses.

Focusing on highly competitive lines after deregulation we find a significant price decrease and this decrease is offset by higher prices in the remaining other lines. Insurance regulatory law is primarily enforced through regulations rules and directives by state insurance departments as authorized and directed by statutory law enacted by the state. Insurance regulatory law is the body of statutory law administrative regulations and jurisprudence that governs and regulates the insurance industry and those engaged in the business of insurance.

Rates vary according to how likely it is a claim will be filed and how much it. PwC predicts pricing for home and motor insurance to fall as changes to regulation take effect The cost of home and motor insurance may fall in 2021 according to predictions by PwC UK. Possible negative results from these lines get offset by products that are not as easily comparable across insurers.

Harrington and Danzn 1994 develop a theoretical model which shows that if some. 11302010 Factors influencing premium changes are significantly different for the two time periods pre and postderegulation indicating that regulation affects insurance pricing. The FCAs General Insurance Pricing Review is a single piece of work focusing on motor and home insurance which forms part of a broader regulatory agenda incorporating the FCAs growing focus on ensuring good customer outcomes and value for money and willingness to use direct price intervention and the Senior Managers Regime proactively to these ends.

It varies by line of insurance. Coarse insurer pricing strategies identify consumer demand. Successful access to the Chinese pharmaceutical market relies on an in-depth knowledge of the relevant PRC laws and regulations not only in terms of regulatory regulations but also pricing anti-corruption compliance tax regulations as well as the preferential policies on the market confirmation of whether the product is included in the catalogues of the reimbursable drugs and.

An exposure unit is the unit of measurement used in insurance pricing. Prescription drugs are subject to both public and private reimbursement in Canada and the price negotiated between manufacturers and payors will depend on the specifics of the drug in question. An Overview Presented to the Montana LMACPresented to the Montana LMAC October 28 2009 Ann Clayton Consultant to ERD LMAC 102809 1 WC Insurance Pricing Regulation and History of State Funds Briefing Outline How premiums are setHow premiums are set insurance rate makingrate.

The Effect of Regulation on Insurance Pricing 1 3 1 business lines like auto liability in which insurers compete to acquire new customers. Evolution of state-based regulation. The following trends could have a significant impact on the business and operating environment for insurers in 2021 and beyond.

Regulations are putting pressure on profitability. FCA proposes measures to tackle general insurance pricing concerns 23rd September 2020. Insurance Regulation What is an insurance rate.

712016 Insurance regulation refers to the government overseeing the insurance market to ensure fairness and professionalism among those working for the insurance industry to prevent the market from collapsing and to democratize insurance. 1162014 Definition Insurance pricing A rate is the price per unit of insurance. Loading refers to the amount that must be added to the.

Laws are created for the industry and an agency is put up to make sure these laws are observed. WC Insurance Pricing Regulation and History of State Funds. Younger consumers are twice as price sensitive as older consumers.

Milestones In Banking Legislation And Regulatory Reform Sciencedirect

Milestones In Banking Legislation And Regulatory Reform Sciencedirect

The Price Of Price Optimization In Insurance

The Price Of Price Optimization In Insurance

2 1 Financial Institutions Other Than Depository Financial Institutions Ppt Download

2 1 Financial Institutions Other Than Depository Financial Institutions Ppt Download

Pharmaboardroom Regulatory Pricing And Reimbursement Colombia

Pharmaboardroom Regulatory Pricing And Reimbursement Colombia

Https Www Zurich Com New Joiner Media 969fae61e59d415cbbe39799c9459f65 Ashx

Market Conditions Cycles And Costs Iii

Market Conditions Cycles And Costs Iii

Chapter 3 The Insurance Sector Trends And Systemic Risk Implications Global Financial Stability Report April 2016 Potent Policies For A Successful Normalization

Chapter 3 The Insurance Sector Trends And Systemic Risk Implications Global Financial Stability Report April 2016 Potent Policies For A Successful Normalization

Insurance Solvency Regulation Systems Revista Del Servicio De Estudios Mapfre

Insurance Solvency Regulation Systems Revista Del Servicio De Estudios Mapfre

Insurance Pricing The Proxy Problem The Actuary

Insurance Pricing The Proxy Problem The Actuary

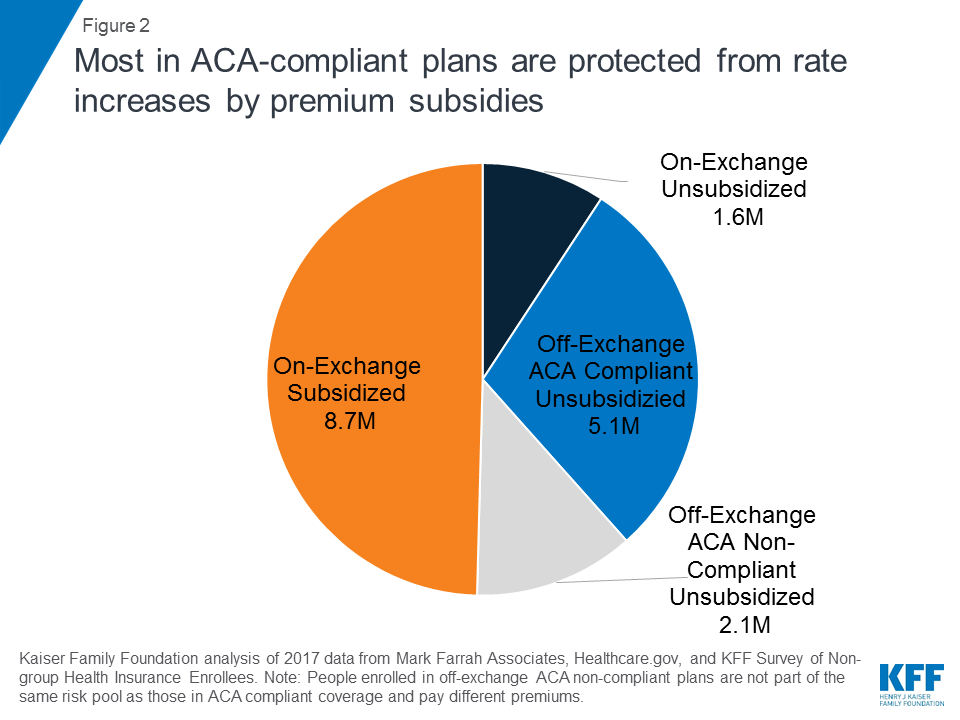

Proposals For Insurance Options That Don T Comply With Aca Rules Trade Offs In Cost And Regulation Kff

Proposals For Insurance Options That Don T Comply With Aca Rules Trade Offs In Cost And Regulation Kff

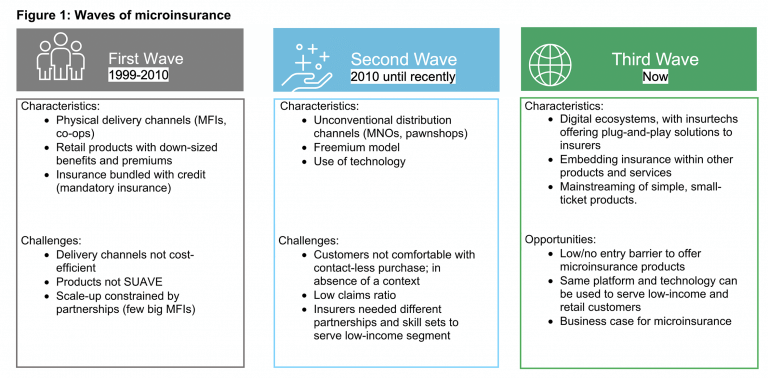

The Third Wave Of Microinsurance

The Third Wave Of Microinsurance

Cost Caps And Coverage For All How To Make Health Care Universally Affordable Third Way

Cost Caps And Coverage For All How To Make Health Care Universally Affordable Third Way

Pharmaboardroom Regulatory Pricing And Reimbursement Colombia

Pharmaboardroom Regulatory Pricing And Reimbursement Colombia

The Fca S General Insurance Pricing Practices Final Report Huntswood

The Fca S General Insurance Pricing Practices Final Report Huntswood

Switzerland Switzerland Detailed Assessment Of Observance Insurance Core Principles

Switzerland Switzerland Detailed Assessment Of Observance Insurance Core Principles

Ci Pricing Detectives Partnerre

Ci Pricing Detectives Partnerre

Denmark Denmark Detailed Assessment Of Observance Of The Insurance Core Principles

Denmark Denmark Detailed Assessment Of Observance Of The Insurance Core Principles

2 1 Financial Institutions Other Than Depository Financial Institutions Ppt Download

2 1 Financial Institutions Other Than Depository Financial Institutions Ppt Download

Post a Comment for "Insurance Pricing Regulation"