Insurance Reimbursement Us Gaap

See below for how we have approached leases financial instruments and insurance. Johnson Lambert GAAP Revenue Recognition for Insurance Entities and Related Organizations.

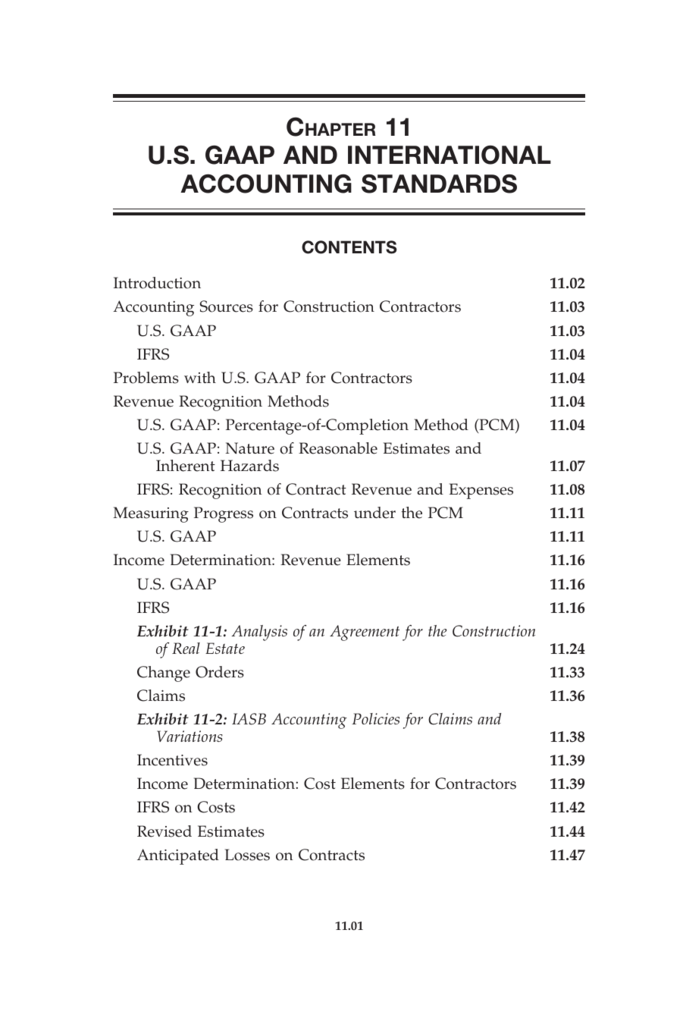

U S Gaap And International Accounting Standards

U S Gaap And International Accounting Standards

A From your subject you could have two types of losses to account for.

Insurance reimbursement us gaap. FS 11 11 US GAAP accounting rules for insurance companies are formulated in different Statements of Financial Accounting Standards SFAS or short FAS FAS 60 FAS 97 and FAS 120 are relevant for insurance product classification FAS 60 issued in 1982 contains the general principles. Many insurance entities listed in Europe and in other jurisdictions implemented IFRS on 1 January 2005. For US GAAP however only the revenue standard is fully effective in annual periods.

This edition of our GAAP Comparison focuses only on currently effective requirements under both IFRS and US GAAP. Similarly we refer to the reporting period rather than to the. Throughout this publication we refer to the reporting date and end of the reporting period.

Reinsurance Recoverables Including Reinsurance Premium Paid. Lessons learned from the US GAAP experience could aid in the application of IFRS. Insurance Proceed on damaged property.

Sometimes the insurance company will pay you less than the amount you paid. 8172013 As a CPA having worked with a CPA firm which supported Insurance Adjustors let me try to be brief about the complex issue of accounting for insurance claim proceeds from a fire loss. Key Takeaways Implementation timelines.

2172017 According to insurance industry accounting standards insurance companies are unique and therefore have different financial transactions than most businesses. Up to the amount of the loss is recognized as a separate asset when recovery is probable ie. 53 Where some or all of the expenditure required to settle a provision is expected to be reimbursed by another party the reimbursement shall be recognised when and only when it is virtually certain that reimbursement will be received if the entity settles the obligation.

Of attendees expect FASB to extend the current effective date for US GAAP Long-Duration Targeted Improvements LDTI past January 1 2022. For non-insurance companies any insurance contract issued is accounted for in accordance with other applicable US GAAP rules. Insurance contracts overview Targeted improvements to US GAAP Short-duration disclosures Final standard released May 2015 Out of scope Contracts written by non-insurance entities Long-duration contracts Deliberations began August 2014 Expected ED in H1 2016 June 2013 FASB and IASB issue exposure drafts.

Useful information shall not be obscured by either the inclusion of a large. Business Interruption and 2. Johnson Lambert is dedicated to keeping you current on the impact of the Financial Accounting Standards Boards FASB Accounting Standards Codification ASC 606 Revenue from Contracts with CustomersASC 606.

New standards and interpretations issued by the IASB Board have a. This usually happens when net book value of the property book value minus accumulated depreciation is more than the amount reimbursed. Debit Loss on Insurance Settlement.

The IASBs new insurance standard expected to be issued in 2016 is likely to establish an accounting model and disclosure requirements that differ significantly from those under US. A matching recognition threshold. The amount of expenses on insured risks paid or due and owing to the ceding entity recorded as additions to net premiums written minus net losses paid minus the sum of loss adjustment expenses and underwriting costs and expenses on insurance ceded to companies outside the United States.

IFRS Standards and US GAAP. For IFRS Standards implementation efforts are complete except for insurance. To the accounting for long-duration insurance contracts.

10302020 Through its insurance subsidiaries the group issues contracts to customers that contain insurance risk financial risk or a combination thereof. A contract under which a group accepts significant insurance risk from another party by agreeing to compensate that party on the occurrence of a specified uncertain future event is classified as an insurance contract. Page 3 Insurance generally accepted accounting principles GAAP update Disclosures about short-duration contracts Overview Disaggregation principle is applied to certain disclosures about claims development and other disclosures about claims liabilities.

The reimbursement asset cannot exceed the related provision amount. IFRS are broadly similar to US GAAP. IFRS 17 US GAAP Scope Impacts all entities insurance or non-insurance companies that issue insurance contracts.

The IASBs stable platform for IFRS 2005 included IFRS 3 Business Combinations IFRS 3. Insurance companies create value by doing several activities such as paying claims up front and then trying to collect a reimbursement paying a portion of a claim and sharing responsibility with another. Under both IFRS Standards and US GAAP with major new standards on revenue leases financial instruments and insurance.

The IASB Board and the FASB take different approaches to the effective dates of new pronouncements. Further in December 2015 the IASB issued an ED to address IFRS 9 adoption for entities that are subject to the insurance standard. B Have a meeting with your insurance agent and HIS companys adjuster.

Specific reporting and accounting guidelines are applicable to insurance companies. The FASB is considering whether to defer the implementation of LDTI for all entities for at least one year beyond the current effective dates. Unlike IFRS under US GAAP a recovery of a loss contingency ie.

If this is the case record the entries as.

Ppt Ias 37 Provisions Contingencies Comparative Analysis With Us Gaap Powerpoint Presentation Id 4674432

Ppt Ias 37 Provisions Contingencies Comparative Analysis With Us Gaap Powerpoint Presentation Id 4674432

20 2 Financial Reporting Considerations Related To Covid 19 And An Economic Downturn March 25 2020 Last Updated January 11 2021 Dart Deloitte Accounting Research Tool

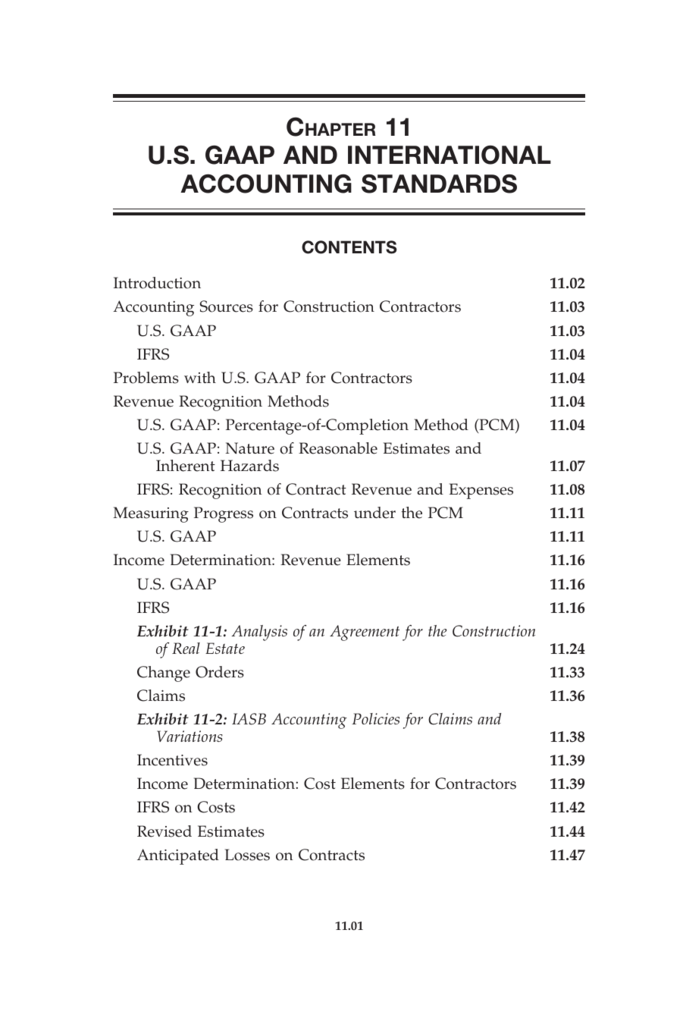

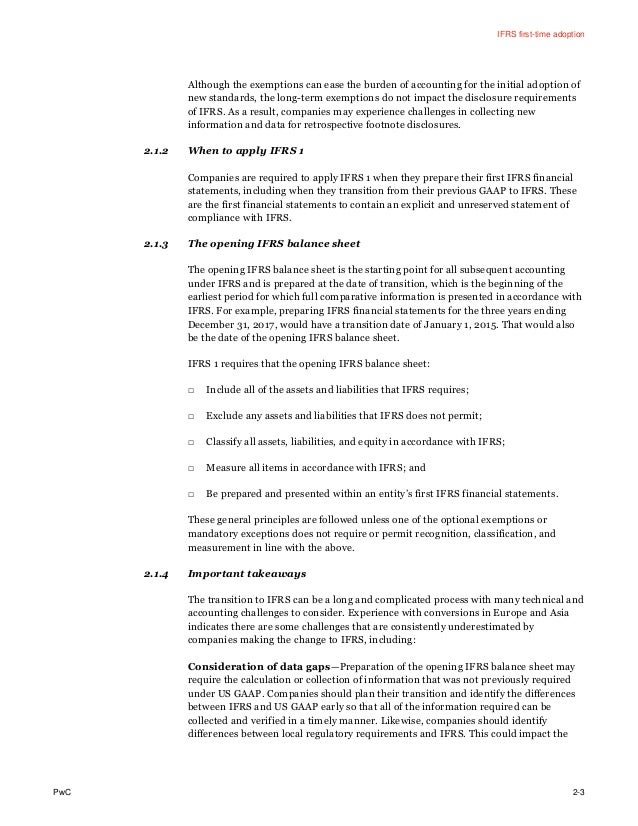

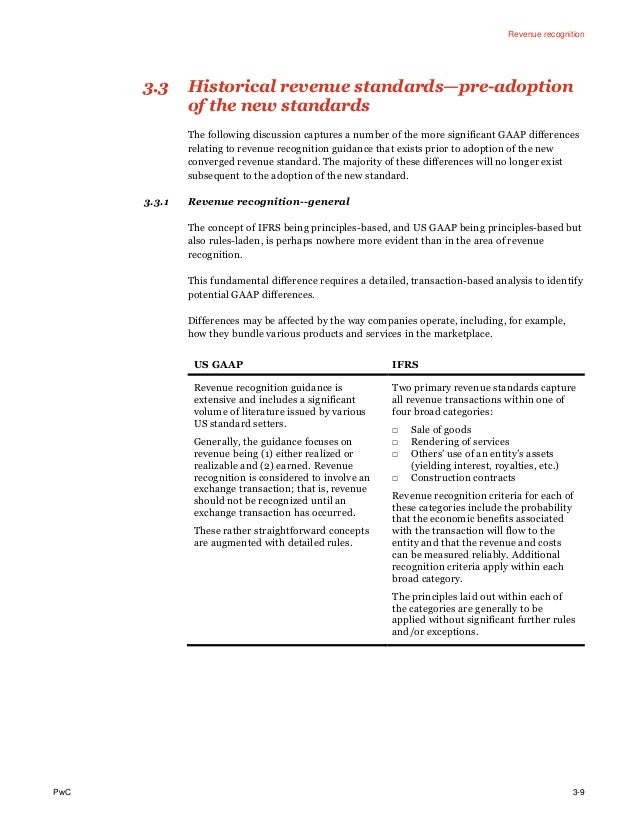

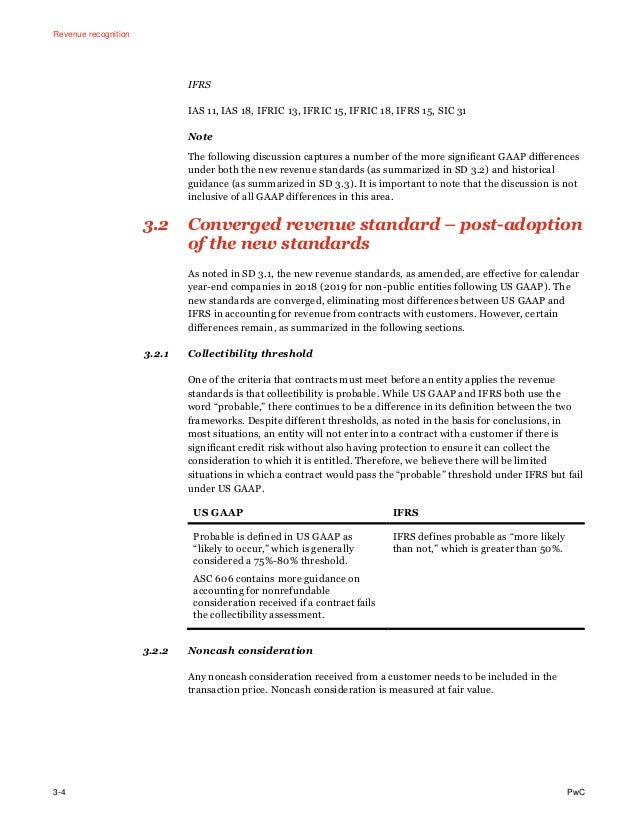

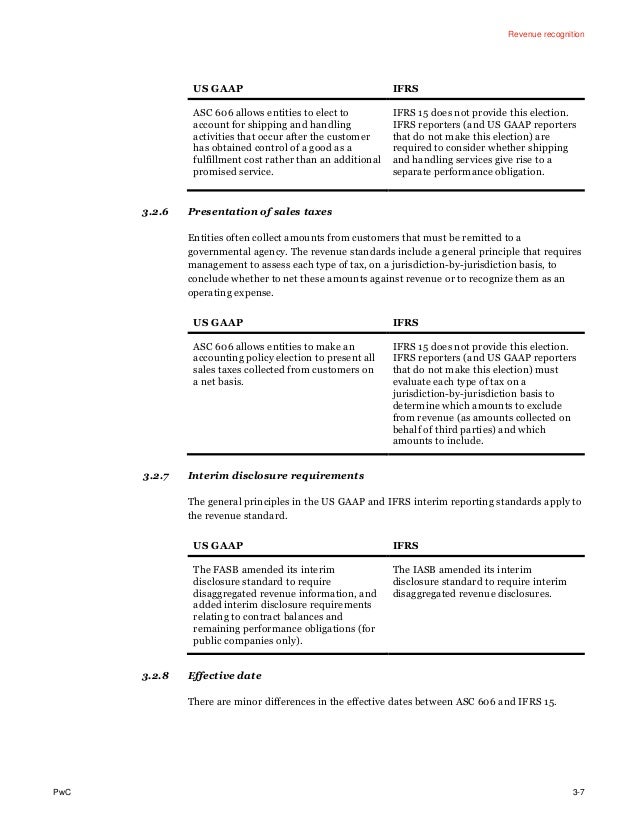

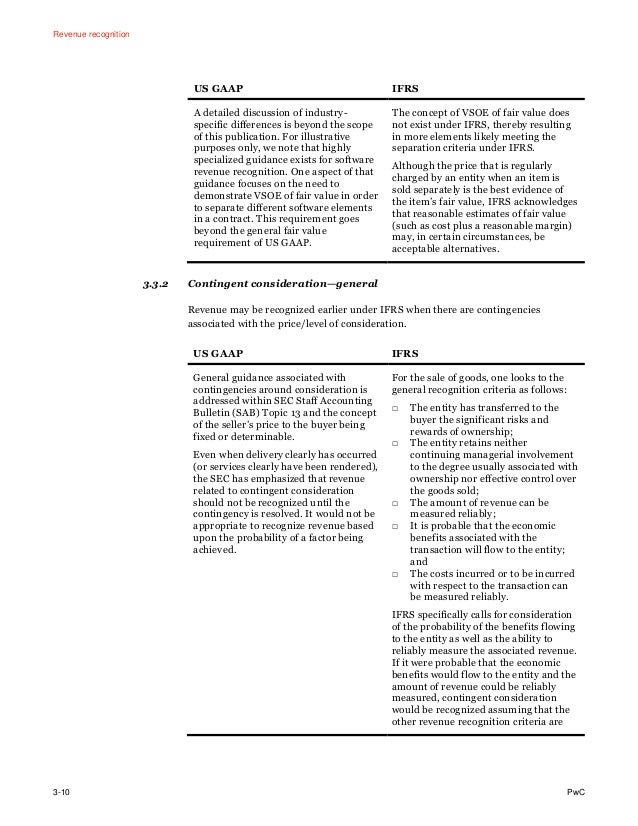

Ifrs And Us Gaap Similarities And Differences Pwc 2017

Ifrs And Us Gaap Similarities And Differences Pwc 2017

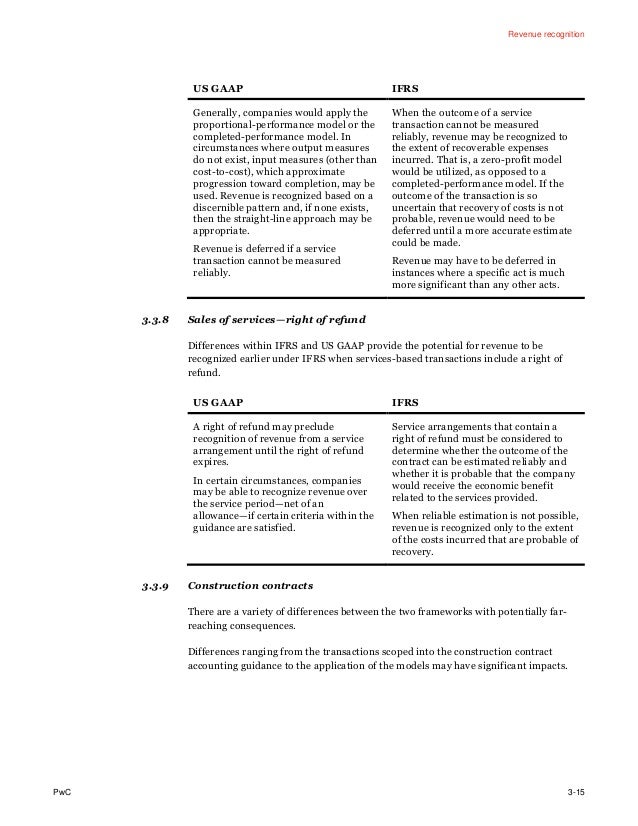

Ifrs Chart Of Accounts Ifrs And Us Gaap

Ifrs Chart Of Accounts Ifrs And Us Gaap

Ifrs Vs Us Gaap Employee Benefits Annual Reporting

Ifrs Vs Us Gaap Employee Benefits Annual Reporting

Ifrs And Us Gaap Similarities And Differences Pwc 2017

Ifrs And Us Gaap Similarities And Differences Pwc 2017

Ifrs And Us Gaap Similarities And Differences Pwc 2017

Ifrs And Us Gaap Similarities And Differences Pwc 2017

Ifrs And Us Gaap Similarities And Differences Pwc 2017

Ifrs And Us Gaap Similarities And Differences Pwc 2017

Ifrs And Us Gaap Similarities And Differences Pwc 2017

Ifrs And Us Gaap Similarities And Differences Pwc 2017

Ifrs And Us Gaap Similarities And Differences Pwc 2017

Ifrs And Us Gaap Similarities And Differences Pwc 2017

Prepare Balance Sheets And Profit Loss A C In Ifrs Format Statement Template Balance Sheet Financial Statement

Prepare Balance Sheets And Profit Loss A C In Ifrs Format Statement Template Balance Sheet Financial Statement

Ifrs And Us Gaap Similarities And Differences Pwc 2017

Ifrs And Us Gaap Similarities And Differences Pwc 2017

Wiley Interpretation And Application Of Ifrs Standards Money Book Ebook Pdf Books Download

Wiley Interpretation And Application Of Ifrs Standards Money Book Ebook Pdf Books Download

Ifrs And Us Gaap Similarities And Differences Pwc 2017

Ifrs And Us Gaap Similarities And Differences Pwc 2017

Ifrs And Us Gaap Similarities And Differences Pwc 2017

Ifrs And Us Gaap Similarities And Differences Pwc 2017

Ifrs And Us Gaap Similarities And Differences Pwc 2017

Ifrs And Us Gaap Similarities And Differences Pwc 2017

Ifrs And Us Gaap Similarities And Differences Pwc 2017

Ifrs And Us Gaap Similarities And Differences Pwc 2017

Post a Comment for "Insurance Reimbursement Us Gaap"