Life Insurance No 1099

6222016 Life insurance is actually a rather sweet tax deal. More specifically Box 1 of the 1099-R will show the 50000 distribution.

Missing An Irs Form 1099 Don T Ask For It

Missing An Irs Form 1099 Don T Ask For It

When the monies are paid to the beneficiary of the policy they can use the funds in the manner they see best.

Life insurance no 1099. A 1099-R specifically reports taxable income from a retirement account like an IRA or an annuity. You may not need it to file your taxes. 992020 The insurance company declares the interest rate on this account once per year.

1162020 You will however receive a 1099-R reporting a 50000 distribution paid to you by your life insurance company. While both forms report income that is generated by an insurance policy Form 1099-INT is used to report interest credited on certain policy proceeds. If you own an annuity the 1099-R could be the result of a full surrender a partial withdrawal or the transfer of.

382021 File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of 10 or more from. That is why I find it so distressing when someone manages to use life insurance to manufacture phantom income for themselves that produces a tax. As this form should have no impact on your tax return it may not even need to be entered in the program.

If youve been using this option for some time its possible that the dividend payments were reducing your cost basis and you just recently reached a point where this dropped your cost basis to zero. However you do not need to file Form 1099-R to report the surrender of a life insurance contract if it is reasonable to believe that none of the payment is includible in the income of the recipient. If you own a life insurance policy the 1099-R could be the result of a taxable event such as a full surrender partial withdrawal loan or dividend transaction.

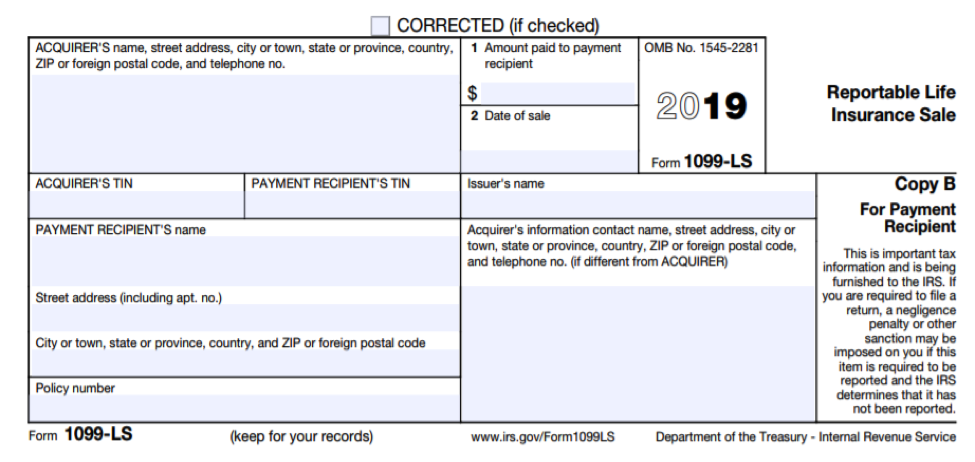

Company that bears the risk with respect to the life insurance contract on the date a Form 1099-LS is required to be furnished to you. Endowment and life insurance contracts. 292020 Life Insurance surrender no 1099-R I cashed in an old policy and the issuing company provided the necessary data for filing but said I would get no 1099-R because the cash value of the original policy was less than 5000 and it was issued before August 12 1982.

However you do not need to file Form 1099-R to report the surrender of a life insurance contract if it is reasonable to believe that none of the payment is includible in the income of the recipient. However you do not need to file Form 1099-R to report the surrender of a life insurance contract if it is reasonable to believe that none of the payment is includible in the income of the recipient. This would explain why no 1099-R arrived before now.

If you are reporting the surrender of a life insurance contract see Code 7 later. 9152012 When the net policy value is eroded the company issues a 1099 for many years worth of earnings. Report payments of matured or redeemed annuity endowment and life insurance contracts.

Life insurance guide Life insurance calculator Term life insurance Whole life insurance Term vs whole life insurance No-medical exam life insurance. Profit-sharing or retirement plans. In some cases it has been on policies that.

1282019 It should show all Forms 1099 issued under your Social Security number. If you receive a Form 1099-R with a Code 6 in Box 7 it is indicating a tax-free exchange of life insurance annuity or endowment contracts under section 1035. Answered on May 7 2014.

Annuities pensions insurance contracts survivor income benefit plans. 1292017 Missing a 1099-MISC form. If you are reporting the surrender of a life insurance contract see Code 7 later.

That is better that asking for a Form 1099 especially for something like a lawsuit recovery. Forms 1099-R and 1099-INT will be available on MyNYL or mailed to you by January 31 st each year. If blank the information is.

This is one of the big attractions for people to buy life insurance policies. 532014 Life insurance proceeds are income-tax free and are therefore the insurance company does not send you a 1099 for the monies. Acquirers information contact name address and phone number.

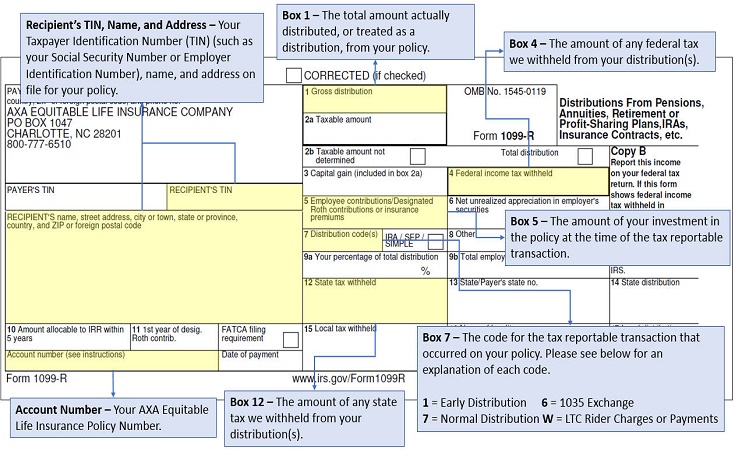

Form 1099-R is sent when distributions or other policy activity occurs that is reportable to the IRS. Form 1099-R is used to report designated distributions of a policys internal earnings gain that were previously untaxed. 452013 A 1099-R is not issued when a life insurance policy pays its death benefit since life insurance proceeds are not subject to federal income tax.

There are two types of 1099s 1099-INT and 1099-R. Form 1099-INT is sent when you earn or receive interest that is reportable to the IRS. The 1099 will report the distribution amount of 50000 and also report that 0 is taxable.

Life insurance annuity and endowment contracts. Any individual retirement arrangements IRAs. Shows the contact information of the acquirer.

Per the IRS Instructions for Forms 1099-R and 5498.

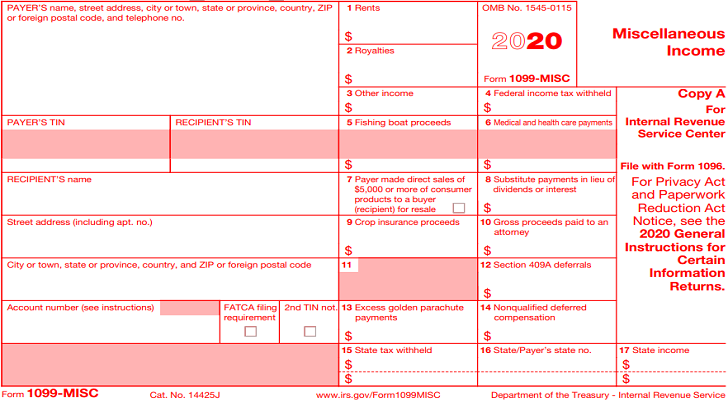

What Is Irs Form 1099 Misc Smartasset

What Is Irs Form 1099 Misc Smartasset

Life Insurance Policy Loans Tax Rules And Risks

Life Insurance Policy Loans Tax Rules And Risks

/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Understanding Your Tax Forms 2016 1099 Misc Miscellaneous Income

Understanding Your Tax Forms 2016 1099 Misc Miscellaneous Income

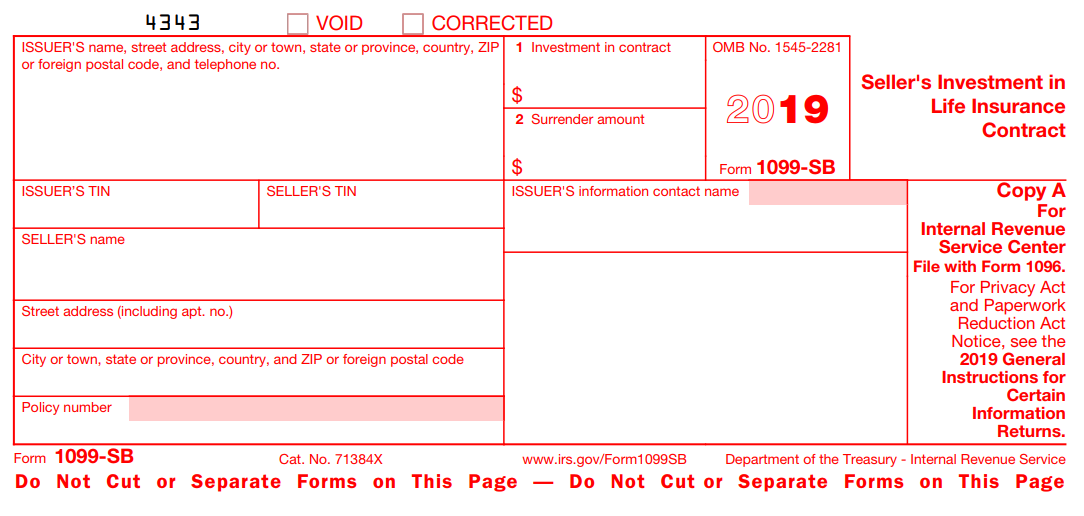

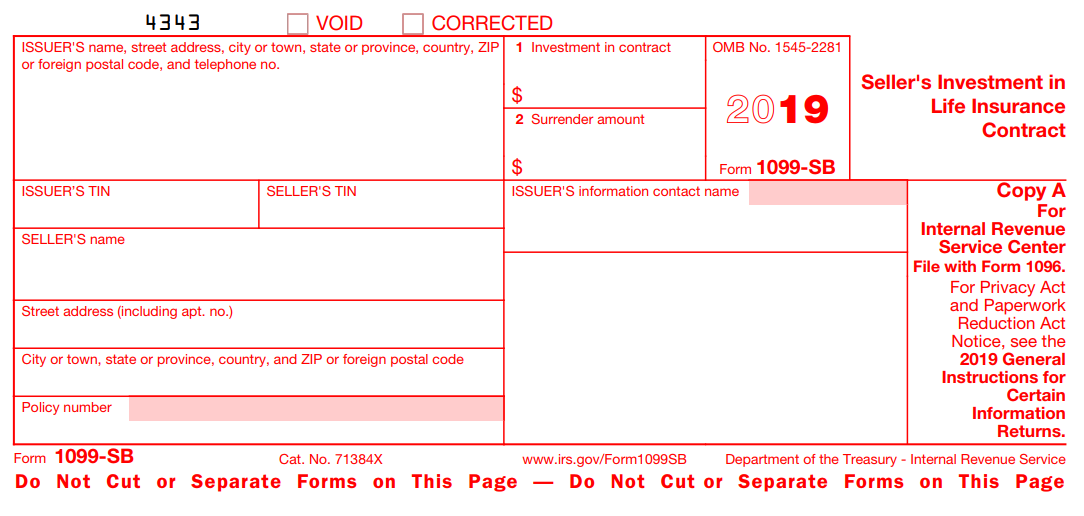

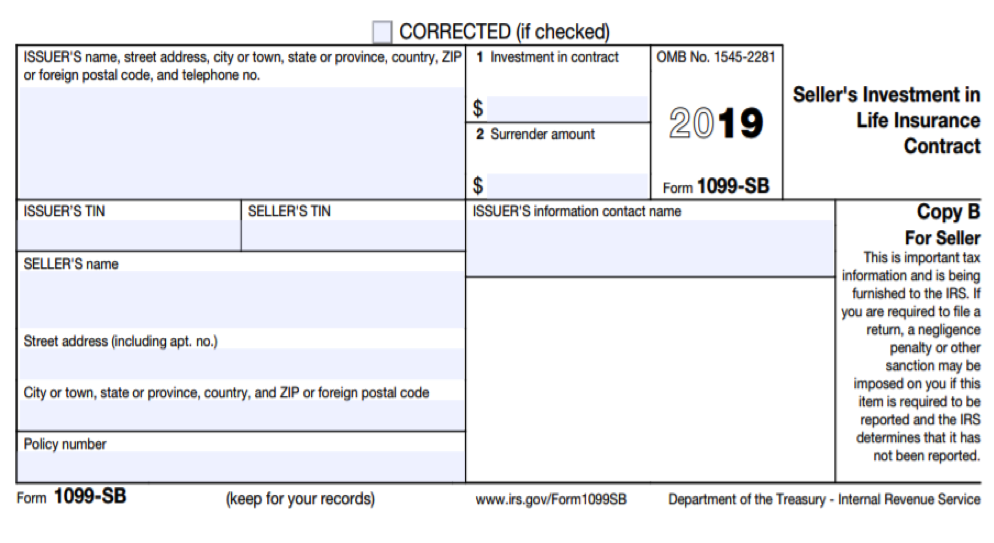

1099 Sb 2019 Public Documents 1099 Pro Wiki

1099 Sb 2019 Public Documents 1099 Pro Wiki

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

Instructions For Forms 1099 Misc And 1099 Nec 2020 Internal Revenue Service 1099 Tax Form Meeting Agenda Template Employer Identification Number

Instructions For Forms 1099 Misc And 1099 Nec 2020 Internal Revenue Service 1099 Tax Form Meeting Agenda Template Employer Identification Number

Form 1099 Ls Reportable Life Insurance Sale Irs Compliance

Form 1099 Ls Reportable Life Insurance Sale Irs Compliance

Form 1099 Sb Seller S Investment In Life Insurance Contract Irs Compliance

Form 1099 Sb Seller S Investment In Life Insurance Contract Irs Compliance

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) 10 Things You Should Know About Form 1099

10 Things You Should Know About Form 1099

How To Calculate Taxable Amount On A 1099 R For Life Insurance

How To Calculate Taxable Amount On A 1099 R For Life Insurance

Post a Comment for "Life Insurance No 1099"